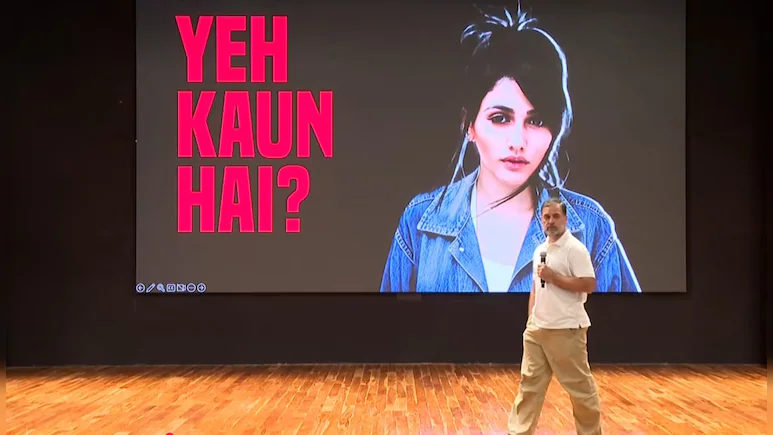

State GST tax evasion soars to Rs 39,577 cr in FY25

Central GST officers in Karnataka detected 1,254 evasion cases worth ₹39,577 crore in FY25, over five times last year’s figure, with nine arrests and ₹1,623 crore recovered voluntarily.

PTI

.png)

NEW DELHI, 11 AUG

Central GST officers in the State uncovered staggering tax evasion amounting to Rs 39,577 crore in the 2024-25 fiscal year, marking an over five-fold increase compared to the previous year. In a written response to the Lok Sabha, Finance Minister Nirmala Sitharaman stated, "Central GST authorities have not issued any notices based on UPI transactions."

This statement comes on the heels of a wave of disproportionately high GST notices received by numerous small traders and shopkeepers in Bengaluru, largely driven by their digital footprints, including UPI transactions, issued by State GST field offices.

Sitharaman detailed that 1,254 cases of Goods and Services Tax (GST) evasion had been detected by Central GST officers in Karnataka during the period. The response further revealed that nine individuals were arrested, and Rs 1,623 crore was collected via voluntary payments.

In contrast, the previous fiscal year (2023-24) saw only 925 cases involving Rs 7,202 crore in evasion, with just two arrests and Rs 1,197 crore collected voluntarily. The trend indicates a significant escalation in tax evasion cases, raising concerns among authorities regarding compliance and enforcement.

Leave a Reply

Your email address will not be published. Required fields are marked *

.png)

.png)

.png)

.png)