Shares in Asia mixed amid Trump's new tariff deadlines

Japan's Nikkei 225 is up 0.2% to 39,764. 02, while South Korea's Kospi added 0.5% to 3,132.02 as Tokyo and Seoul are working a trade deal with the US before higher tariffs announced by Washington take effect on 1 August.

PTI

-

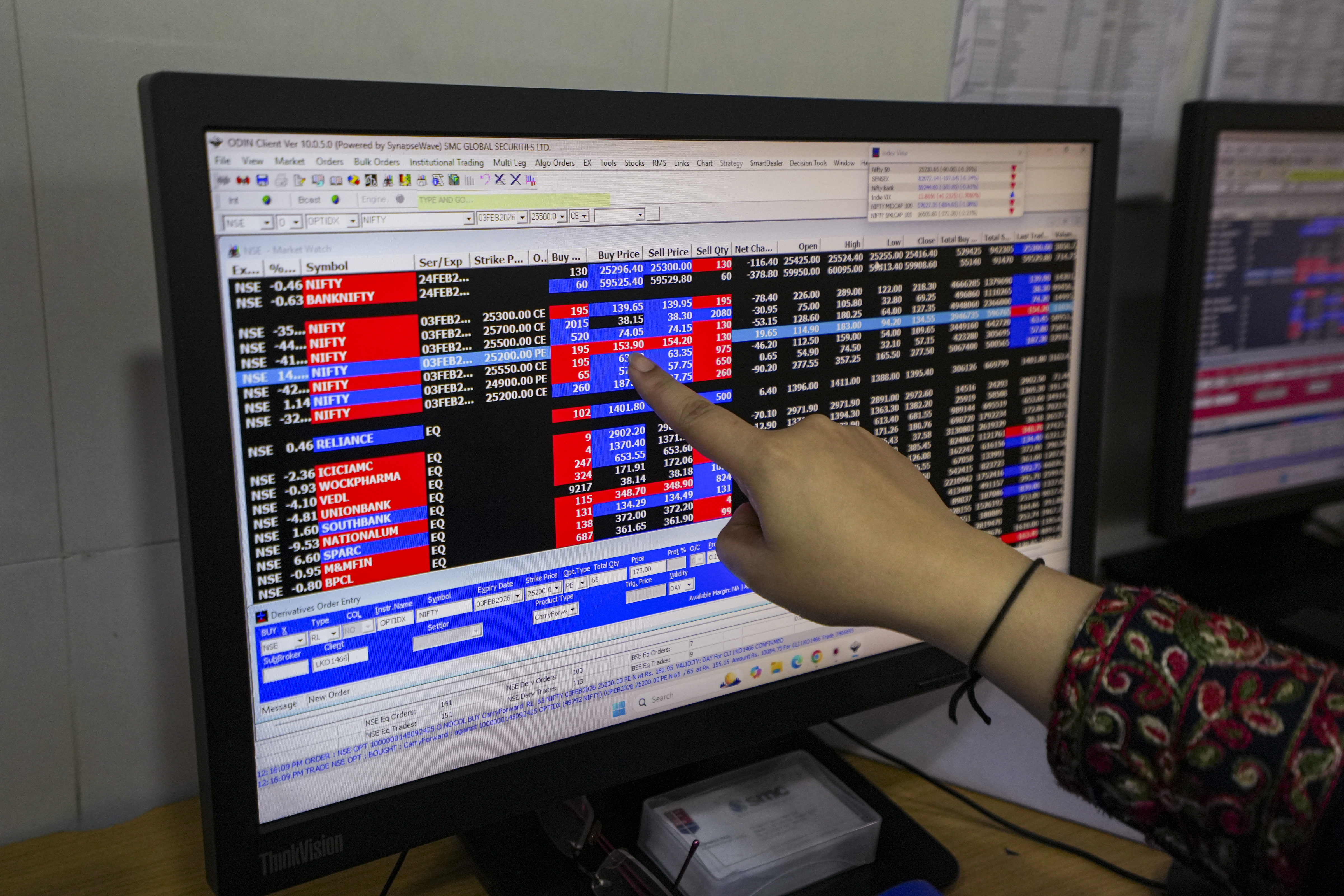

Representative image

Hong Kong, 8 July

Shares were mixed in Asia on Wednesday, following a choppy trading

day on Wall Street as the Trump administration pressed its campaign to win more

favourable trade deals with nations around the globe.

Japan's

Nikkei 225 is up 0.2% to 39,764. 02, while South Korea's Kospi added 0.5% to

3,132.02 as Tokyo and Seoul are working a trade deal with the US before higher tariffs announced by Washington take effect on 1 August.

“Sectoral

carve-outs remain the thorniest terrain," Stephen Innes of SPI Asset

Management wrote in a commentary, adding that Korea and Japan are likely

seeking relief for their car and steel exports. "But Washington is

unlikely to bend,” he warned.

Meanwhile,

Chinese markets were mixed. Hong Kong's Hang Seng index fell 0.7% to 23,970.39

while the Shanghai Composite index rose 0.3% to 3,507.69.

Australia's

S&P/ASX 200 slipped 0.4% to 8,559.30. India's BSE Sensex edged down 0.2% to

83,570.86.

Oil

prices were down while the dollar rose against the yen and the euro.

Mizuho

Bank, in a commentary, said the tariff deadlines “distract from far more

consequential, and expedient, sectoral tariffs, which arguably reverberate

across global industrial eco-systems” which it said aim to isolate China from

trade partners, supply chains and markets.

“The

real danger is underestimating the fallout when (rather than if) China hits

back" against the US and countries it perceives as aligned with the

U.S., the bank wrote.

On

Wall Street on Tuesday, the S&P 500 slipped 0.1% a day after posting its

biggest loss since mid-June. The benchmark index remains near its all-time high

set last week.

The

Dow Jones Industrial Average gave back 0.4%. The Nasdaq composite eked out a

gain of less than 0.1%, staying near its own record high.

The

sluggish trading came as the market was coming off a broad sell-off following

the Trump administration's decision to impose new import tariffs on more than a

dozen nations, which are set to go into effect next month.

Leave a Reply

Your email address will not be published. Required fields are marked *

.png)

.png)